Emas tutup pada hari sabtu lalu dengan harga tinggi....

Minggu depan pakar2 menyatakan akan naik lagi......

jom..... kita beli emas sekarang... sebelum naik...... lagi......

Bandingkan harga dengan lihat gambar2 yang post sebelum ini... dalam "harga emas terkini"

Saturday 15 February 2014

Thursday 13 February 2014

naik2....

tu dia...... emas naik di pg jumaat ni......................

cek blik blog saya yang lepas, tgk bezanye.....

Tuesday 11 February 2014

Monday 10 February 2014

EMAS NAIK....

Saturday 8 February 2014

sumber : Jutawanemas (Syukor Hashim, Admin Jutawanemas.com)

Mengapa Public Gold?

Mengapa Public Gold? Jawapannya:

1. Public Gold adalah syarikat terbesar di Malaysia yang menjual emas dan perak untuk tujuan pelaburan.

Public Gold adalah sebuah syarikat yang menjual dan membeli emas pelaburan yang terbesar di Malaysia. Jenama Public Gold sudah berada di pasaran sejak tahun 2008 sehingga sekarang.

Public Gold mempunyai 17 buah cawangan di seluruh Malaysia (termasuk Sabah dan Sarawak) dan mempunyai sebuah anak syarikat yang mengoperasikan Peti Simpanan Selamat (safe deposit box) di Pulau Pinang dengan kapasiti 5000 buah peti simpanan.

Ini adalah senarai cawangan Public Gold di seluruh Malaysia (boleh klik sini juga)

Cawangan | Nombor Telefon | Alamat |

| Ampang, KL | 03-42579916 | 98A & 98B, Lorong Mamanda 2, Ampang Point Batu 41/2, Jalan Ampang, 68000 Ampang (Bersebelahan Habib Jewel Ampang point) |

| Alor Setar, Kedah | 04-7344916 | No.1577, tingkat 1 dan 2, Jalan Kota, Alor Setar, 05000 Kedah. |

| Sungai Petani, Kedah | 04-4232999 | No.86B, 1st Floor, Jalan Pengkalan Taman Pekan Baru, 08000 Sungai Petani, Kedah. (bersebelahan Public Bank Jalan Kota) |

| Bukit Jambul, Penang | 04-6449999 | 12E, 1st Floor, Jalan Rumbia, Bukit Jambul, 11900 Bayan Lepas, Pulau Pinang. |

| Bishop, Penang | 04-261999 | No.84, Lebuh Bishop, 10200 Penang. |

| Ipoh, Perak | 05-2428999 | No.45, 45A & 45B, Jalan Yang Kalsom, 30250 Ipoh, Perak. (Bertentangan Public Bank Jalan Yang Kalsom) |

| Petaling Jaya, Selangor | 03-56348999 | 42A, Jalan PJS 8/6 (Tingkat 3) Mentari Business Park, Bandar Sunway, 46150 Petaling Jaya, Selangor. (di atas Royal Safe Deposit Box) |

| Seremban, N.Sembilan | 06-6782916 | 152-1 & 152-2, Block M, Taipan Senawang, Jalan Taman Komersil Senawang 1, Taman Komersil Senawang, 70450 Seremban, Negeri Sembilan. (Berhampiran Bank Rakyat Taipan Senawan) |

| Melaka | 06-3175499 | No.9-A, 9-B, Jalan Melaka Baru 22, Taman Melaka Baru, Batu Berendam, 75350 Melaka. (sebelah Perodua) |

| JB, Johor | 07-2358999 | No.45A&B, Jalan Persisiran Perling, Taman Perling, 81200 Johor Bahru, Johor. (Bersebelahan Maybank Taman Perling) |

| KB, Kelantan | 09-7462999 | Tingkat 1, Lot 257, Jalan Kebun Sultan, 15000 Kota Bharu, Kelantan. (sebelah Public Bank Jalan Kebun Sultan) |

| Kuala Terengganu, Terengganu. | 09-6263999 | 16A, 1st &2nd Floor, Jalan Sultan Ismail, 20200 Kuala Terengganu. (Sebelah KFC dan Farmasi Guardian.) |

| Kuantan,Pahang | 09-5678916 | A-6624 1st &2nd Floor, Jalan Beserah, 25250 Kuantan, Pahang. (Sebelah Maybank Jalan Beserah) |

| Kuching, Sarawak | 082-259916 | Lot 456 & 457, tingkat 3, Al-Idrus Commercial Centre, Jalan Satok, 93400 Kuching, Sarawak. (Sebelah Maybank Jalan Satok) |

| Klang, Selangor | 03-33438916 | No.2, 3rd Floor, Jalan Tiara 2, Bandar Baru Klang, 41150 Klang, Selangor Darul Ehsan. (Diatas bank HSBC) |

| Kajang, Selangor | 03-87349916 | No.19B, 19C, Jalan M/J1, Taman Majlis Jaya, Sungai Chua, 43000 Kajang, Selangor Darul Ehsan. |

| Kota Kinabalu, Sabah | 088-447 916 | Lot No. 19, Block B-10, Corner Lot, 1st, 2nd Floor, Lorong Plaza Permai 1, Along Jalan Sulaman, Kota Kinabalu, Sabah (sebelah Maybank Alam Mesra, 1 Borneo) |

2. Harga emasnya jauh lebih murah dari kedai emas.

Public Gold adalah kilang emas. Jadi harga kilang tentulah lebih murah dari harga kedai emas (jimat RM20 ++ segram). Harga emas Public Gold boleh tengok kat sini: www.publicgold.com.my

3. Susutnilai emas Public Gold jauh lebih rendah dari kedai emas.

Susutnilai emas di kedai emas adalah antara 18% ke 30% (tingginya!)

Tetapi susutnilai emas Public Gold sangat kecil….

i. 4.5% sehingga 8% untuk jongkong emas

ii. antara 5% – 6% untuk dinar emas 916

iii. 10% sahaja untuk barang kemas i-series

iv. 12% ke 16% untuk jongkong perak 999.0

ii. antara 5% – 6% untuk dinar emas 916

iii. 10% sahaja untuk barang kemas i-series

iv. 12% ke 16% untuk jongkong perak 999.0

Jadi bila susutnilai rendah, keuntungan pembeli adalah lebih cepat!

4. Pelbagai produk yang dijual mengikut citarasa dan kemampuan anda.

Public Gold mengeluarkan jongkong emas, dinar emas, barang kemas, jongkong perak dan syiling perak.

Anda boleh pilih apa-apa sahaja produk mengikut citarasa dan kesesuaian budget anda.

i. Untuk jongkong emas 999.9 anda boleh memilih dari berat berikut:

(10 gram, 20 gram, 50 gram, 100 gram, 250 gram dan 500 gram

(10 gram, 20 gram, 50 gram, 100 gram, 250 gram dan 500 gram

ii. Untuk dinar emas 916 anda boleh memilih dari sebarang dinar bermula dengan:

1 dinar (4.25 gram), 2 dinar (8.50 gram), 5 dinar (21.25 gram)

atau 10 dinar (42.50 gram)

1 dinar (4.25 gram), 2 dinar (8.50 gram), 5 dinar (21.25 gram)

atau 10 dinar (42.50 gram)

iii. Untuk barang kemas 916 i-series, anda boleh memilih:

buah rantai (5 gram dan 10 gram), rantai tangan (10 gram),

rantai leher (20 gram, 50 gram dan 100 gram)

buah rantai (5 gram dan 10 gram), rantai tangan (10 gram),

rantai leher (20 gram, 50 gram dan 100 gram)

iv. Untuk jongkong perak 999.0 anda boleh memilih jongkong

dengan berat( 100 gram, 250 gram, 500 gram dan 1 kilogram)

dengan berat( 100 gram, 250 gram, 500 gram dan 1 kilogram)

v. Untuk syiling perak 999.0, anda boleh memilih syiling 10 dirham

(berat 29.75 gram, perak 999.0)

(berat 29.75 gram, perak 999.0)

Sebahagian daripada produk-produk Public Gold boleh dilihat dibawah.

5. Sistem tempahan dan jualan balik 24 jam sehari, 365 hari setahun!

Sistem tempahan online Public Gold beroperasi 24 jam sehari dan 365 hari setahun. Jadi anda boleh beli emas @ menjual semula emas mereka pada bila-bila masa sahaja.

Jadi, pukul berapa pun anda baca artikel ini, anda boleh membeli emas Public Gold tanpa sebarang masalah. Best kan?

6. Cawangan Public Gold ada di seluruh Malaysia.

Public Gold mempunyai cawangan di seluruh Malaysia termasuk di Sabah dan Sarawak (kecuali Perlis). Anda boleh lihat senarai cawangan Public Gold di seluruh Malaysia disini (klik sini)

7. Harga emas yang dinamik dan berubah setiap 20 minit.

Satu fakta yang menarik tentang Public Gold ialah harganya berubah setiap 20 minit mengikut pergerakan harga emas dunia. Berbeza dengan kedai emas yang lambat berubah harganya (kekadang sampai berminggu-minggu). Jadi anda boleh melihat kenaikan dan penurunan harga dengan pantas.

Ia membolehkan anda merancang urusan membeli dan menjual dengan mudah!

8. Urusniaga jualan yang patuh syariah.

Apabila anda membeli emas dengan Public Gold maka anda akan mendapat emas fizikal dan simpan sendiri. Ini adalah 100% patuh syariah!

Contoh urusniaga yang tidak patuh syariah ialah apabila anda membeli emas melalui akaun simpanan emas yang ditawarkan oleh bank-bank. Walaupun nampak harga emas mereka murah, tetapi pembeli tidak mendapat emas fizikal. Cuma catatan di dalam buku sahaja.

Bagi memahami hukum membeli emas melalui akaun simpanan emas, anda boleh melihat soalan dan jawapan di dalam laman web Ustaz Zaharuddin di sini http://zaharuddin.net/pelaburan-&-perniagaan/764-hukum-akaun-pelaburan-emas-di-bank-malaysia.html

Apabila kita membeli emas samada di bank atau di kedai emas ia mestilah memenuhi syarat-syarat berikut:

Pertama bank, kedai emas @ syarikat yang menjual emas memiliki emas yang dijual semasa menjual.

Kedua, bank @ kedai emas tersebut memberikan bukti pemilikan kepada pelanggan sama ada dalam bentuk fizikal emas atau bentuk sijil hak ke atas nilai emas yang dibeli.

Kedua, bank @ kedai emas tersebut memberikan bukti pemilikan kepada pelanggan sama ada dalam bentuk fizikal emas atau bentuk sijil hak ke atas nilai emas yang dibeli.

Anda perlu berhati-hati. Apabila pelaburan emas menjadi semakin popular, maka banyak bank dan juga syarikat-syarikat menawarkan peluang pelaburan emas. Namun segelintir orang sahaja yang mengambil kira soal halal haram transaksi pembelian emas menurut Islam.

Dengan Public Gold, bila anda beli emas, maka anda akan dapat emas tersebut.

Anda pegang dan simpan sendiri. Memang best…

Okie, saya telah menunjukkan 8 kelebihan Public Gold, sekarang tiba masa yang dinanti-nantikan…

Bagaimana cara membeli produk Public Gold.

Saya akan menunjukkan 3 kaedah membeli emas Public Gold.

1. Pertama sekali ialah kaedah termudah iaitu secara menghantar sms

2. Kedua, ialah kaedah panggilan telefon ke cawangan Public Gold (waktu bekerja)

3. Ketiga ialah dengan kaedah membuat tempahan online di laman web Public Gold(klik sini)

2. Kedua, ialah kaedah panggilan telefon ke cawangan Public Gold (waktu bekerja)

3. Ketiga ialah dengan kaedah membuat tempahan online di laman web Public Gold(klik sini)

1. Kaedah order pertama: Membeli melalui Order SMS.

Proses membeli emas melalui SMS dimulakan dengan proses lock harga. Memandangkan harga emas Public Gold berubah setiap 20 minit, anda perlu kunci harga emas mengikut harga emas seperti yang tertera di laman web Public Gold.

Proses:

i. Mula-mula anda lihat berapa harga semasa emas @ produk yang anda ingin beli diwww.publicgold.com.my

ii. Kedua, anda taipkan sms di dalam format seperti ini:

Saya, nama anda mengikut IC, Nombor IC anda, Email anda danNombor HP anda, ingin lock, item yang ingin anda beli x berapa unit @ RM(harga semasa dalam website Public Gold). Introducer: Syukor Hashim, PG000012, jutawanemas.com

p/s: Introducer adalah orang yang memperkenalkan anda kepada Public Gold. Dalam kes ini.. sayalah introducer anda

Selepas itu anda hantar SMS ini kepada nombor H/P Branch yang berhampiran dengan anda:

Cawangan

|

Nombor H/P :

|

| Alor Setar, Kedah | 012-4890916 |

| Sungai Petani, Kedah | 012-4836916 |

| Relau, Penang | 012-5282916 |

| Bishop, Penang | 012-4298916 |

| Ipoh, Perak | 012-4398916 |

| Petaling Jaya, Selangor | 012-7082916 |

| Kajang, Selangor | 012-3408916 |

| Ampang, KL | 012-6938916 |

| Klang, Selangor | 012-6718916 |

| Seremban, N.Sembilan | 012-3495916 |

| Melaka | 012-3876916 |

| Johor Bahru, Johor | 012-4308916 |

| Kota Bahru, Kelantan | 017-4859916 |

| Kuala Terengganu,Terengganu | 017-6756916 |

| Kuantan,Pahang | 017-6528916 |

| Kota Kinabalu, Sabah | 016-4107916 |

| Kuching, Sarawak | 017-6788916 |

Sebagai contoh, jika anda tinggal di Subang, anda hantar sms ini kepada nombor h/p cawangan Petaling Jaya di 012-7082916.

Ini adalah contoh SMS:

Nota: Jika anda menghantar SMS ini ketika waktu bekerja, maka staff Public Gold akan menelefon anda untuk membuat pengesahan order tersebut.

Selepas pengesahan mereka akan menghantar sales order ke email anda.

Jika anda menghantar SMS ini selepas waktu bekerja maka esok hari baru staff Public Gold akan menelefon anda.

Jika esok adalah hari cuti maka selepas buka office barulah staff Public Gold akan menelefon anda.

Kos Pengangkutan.

Jika anda membeli produk Public Gold dan mengambilnya di cawangan-cawangan Public Gold di luar Pulau Pinang maka produk anda akan dikenakan kos pengangkutan.

Ini adalah jadual kos pengangkutan bagi produk-produk Public Gold.

Item

|

Kos Pengangkutan seunit (semenanjung Malaysia)

(RM)

|

Kos Pengangkutan seunit

(Sabah & Sarawak)

(RM)

|

| Jongkong emas 10 gram |

10

|

20

|

| Jongkong emas 20 gram |

10

|

20

|

| Jongkong emas/syiling emas 50 gram |

20

|

40

|

| Jongkong emas 100 gram |

30

|

60

|

| Jongkong emas 250 gram |

50

|

100

|

| Jongkong emas 500 gram |

80

|

160

|

| 1 dinar |

0

|

10

|

| 2 dinar |

0

|

15

|

| 5 dinar |

0

|

20

|

| 10 dinar |

0

|

30

|

| Jongkong perak 100 gram |

10

|

20

|

| Jongkong perak 250 gram |

20

|

40

|

| Jongkong perak 500 gram |

30

|

60

|

| Jongkong perak 1 kilogram |

30

|

60

|

| Barang kemas I-series 5 gram |

10

|

20

|

| Barang kemas I-series 10 gram |

10

|

20

|

| Barang kemas I-series 20 gram |

20

|

40

|

| Barang kemas I-series 50 gram |

20

|

40

|

| Barang kemas I-series 100 gram |

20

|

40

|

| Barang kemas D-series |

20

|

40

|

| 10 Dirham |

5

|

10

|

| Nota: Kos pengangkutan untuk semua produk di atas adalah RM0 jika anda mengambil produk-produk Public Gold ini di mana-mana cawangan Public Gold Pulau Pinang. | ||

Setelah berjaya membuat tempahan secara online, anda akan mendapat CSO xxxxxx (Customer Sales Order).

Contoh sales order yang anda akan terima di email anda (klik untuk besarkan)

2. Kaedah order kedua: Order melalui panggilan telefon

Kaedah order melalui telefon boleh dibuat sepanjang tempoh bekerja pejabat Public Gold iaitu:

i. Hari Isnin – Jumaat 9.00 pagi sehingga 6.00 petang

ii. Hari Sabtu 9.00 pagi sehingga 1 tengahari

iii. Hari Ahad (pejabat ditutup)

ii. Hari Sabtu 9.00 pagi sehingga 1 tengahari

iii. Hari Ahad (pejabat ditutup)

Proses order melalui telefon pun mudah sahaja. Anda hanya perlu menelefon pelabat Public Gold yang berhampiran dengan anda.

Lihat nombor telefon cawangan Public Gold di bawah, kemudian telefon sahaja

Cawangan

|

Nombor telefon:

|

| Alor Setar, Kedah | 04-7344916 |

| Sungai Petani, Kedah | 04-4232999 |

| Relau, Penang | 04-6449999 |

| Bishop, Penang | 04-2619999 |

| Ipoh, Perak | 05-2428999 |

| Petaling Jaya, Selangor | 03-56348999 |

| Kajang, Selangor | 03-87349916 |

| Ampang, KL | 03-42579916 |

| Klang, Selangor | 03-33412999 |

| Seremban, N.Sembilan | 06-6782916 |

| Melaka | 06-3175499 |

| Johor Bahru, Johor | 07-2358999 |

| Kota Bahru, Kelantan | 09-7462999 |

| Kuala Terengganu,Terengganu | 09-6263999 |

| Kuantan,Pahang | 09-5678916 |

| Kota Kinabalu, Sabah | 088-447 916 |

| Kuching, Sarawak | 082-259916 |

Beritahu mereka yang anda ingin order produk Public Gold. Kemudian staff akan memaklumkan harga semasa produk tersebut. Jika anda bersetuju maka anda boleh lock harga tersebut melalui telefon. Staff Public Gold akan bertanya nama anda, ic, email dan hp anda serta nama introducer anda.

Beritahu mereka introducer anda adalah Syukor Hashim, PG000012, dari jutawanemas.com.

Selepas itu, staff Public Gold yang berkenaan akan menghantar sales order pembelian emas ke email anda.

Selesai kaedah order melalui telefon…

Tips berharga yang perlu anda tahu:

1. Jika talian sedang sibuk, sila telefon sampai dapat. Mungkin waktu itu ramai orang tengah order. Jangan kecewa, teruskan usaha dengan gigih.

2. Jika tak dapat juga, telefon ke cawangan lain untuk buat order, tetapi beritahu mereka yang anda nak collect order berkenaan di cawangan yang berhampiran dengan anda. Contohnya anda dari Ampang, tetapi tak dapat telefon cawangan Ampang kerana mereka sibuk dan engage ajer. Jadi anda boleh telefon cawangan Kajang atau Senawang atau Melaka atau Ipoh, tetapi anda maklumkan kepada cawangan tersebut yang anda mahu ambil stok di cawangan Ampang.

2. Jika tak dapat juga, telefon ke cawangan lain untuk buat order, tetapi beritahu mereka yang anda nak collect order berkenaan di cawangan yang berhampiran dengan anda. Contohnya anda dari Ampang, tetapi tak dapat telefon cawangan Ampang kerana mereka sibuk dan engage ajer. Jadi anda boleh telefon cawangan Kajang atau Senawang atau Melaka atau Ipoh, tetapi anda maklumkan kepada cawangan tersebut yang anda mahu ambil stok di cawangan Ampang.

3. Kalau tak boleh jugak, order ajer melalui sms atau online. Sebab itu saya tunjukkan tiga kaedah membeli produk Public Gold.

Kaedah ketiga:

p/s: Memandangkan kaedah ini agak panjang lebar, saya letakkan ia di satu page khas. Klik link diatas untuk membacanya. Tapi kalau nak cara yang lebih mudah, anda download sahaja manual 3 kaedah Tempahan Produk Pulic Gold di bawah sana.

Friday 7 February 2014

Ha.... ni dia... Pakar2 bagi tau emas nak naik lagi minggu depan... Betul ke... Mengikut Kajian 2 minggu lepas, memang tepat.... nak tau Jom Kita Join "PG"

Survey Participants Forecast Higher Gold Prices For Next Week

Friday February 7, 2014 11:59 AM

(Kitco News) - Positive technical price charts for gold could encourage the yellow metal to move higher next week, as a majority of participants in the weekly Kitco News Gold Survey forecast higher prices.

In the Kitco News Gold Survey, out of 33 participants, 23 responded this week. Sixteen see prices up, while four see prices down and three see prices trading sideways or are neutral. Market participants include bullion dealers, investment banks, futures traders and technical-chart analysts.

Last week, participants were bullish. As of noon EST, Comex April gold prices were up about $23 an ounce on the week.

Participants who see higher values said gold prices continue to hold in a series of lower lows, which bodes well.

Frank Lesh, broker and futures analyst with FuturePath Trading, said even though gold is stuck in a range, with $1,280 as the ceiling and last week’s low of $1,237 as the floor, prices are trending higher.

“The market is climbing up a trend line and the 20-day (moving average), and does look like it wants to trade higher. When it trades through $1,280, there should be a quick move to $1,300-plus, maybe $1,313 or even $1,335. The dollar remains as the most important influence for gold, but the correlation to equities seems to be lessening somewhat. One of the problems for gold right now is that there are less participants and less momentum. Gold will close well above last week’s close of $1,239 and I expect it (will) be higher next week,” Lesh said.

Those who see weaker prices said in part they’re disappointed gold can’t break through the tough resistance at the $1,280 level.

“We tried to rally (Friday), but gold is flagging up here when it tries to take out $1,280. We have higher lows, but $1,280 is too tough…. I just don’t see gold having the momentum to go over $1,280, especially with a light data week next week,” said Daniel Pavilonis, senior commodities broker with RJO Futures.

The high for the year in April gold so far was $1,280.10 an ounce, hit on Jan. 27.

Emas Sedang mendaki ke atas.....

Betul ke emas akan naik lagi... mengikut laporan pakar2 emas, emas akan naik lagi pada minggu hadapan, Justeru itu kepada yang ada emas boleh le jual balik (yang sudah untung le) kepada yang belum ada emas, boleh mula berjinak2 untuk mempelajari ilmu emas.....

Jom kita sama2 cari "ILMU EMAS"

Tuesday 10 December 2013

Saturday 9 November 2013

CARTA HARGA EMAS MINGGU INI

----> www.mentoremas.com <----

1. Chart pertama adalah commentaries saya pada minggu lepas mengenai posisi dan halatuju harga emas.

2. Chart kedua adalah jangkaan pergerakan harga emas untuk minggu hadapan.

3. Terdapat 2 paras support yang agak kuat pada harga :

i. $1250 / oz

ii. $1180 / oz

4. Berdasarkan kedudukan harga semasa, kemungkinan ia menuju ke paras $1250 / oz memang ada.

5. Jika paras $1250 / oz berjaya dicapai, dan harga emas pula berjaya turun lebih rendah dari paras tersebut, maka wujud kemungkinan untuk ia menuju ke paras $1180 / oz pula.

6. Tapi jika sebaliknya, maka kemungkinan harga menuju ke paras $1180 / oz tidak akan berlaku.

7. Pelabur yang bijak akan membahagikan modal kepada 2 bahagian.

8. Separuh akan diguna untuk membeli ketika harga mencapai $1250 / oz, dan separuh lagi sebagai persediaan untuk membeli jika harga turun lagi ke paras $1180 / oz.

9. Kalau paras $1180 / oz tidak dicapai dan harga dah naik semula? Tak apa, kan dah beli di paras $1250 / oz. Simpan lah modal yang separuh lagi dalam bank.

10. Kalau sebelum ni dah ada buat belian macamana? Ada 3 pilihan untuk anda pilih sendiri yang sesuai dengan risk profile anda, iaitu :

i. Tunggu dan biar harga naik semula (Low Risk).

ii. Tambah modal baharu dan gunakan untuk menambah belian pada harga yang rendah iaitu $1250 & $1180 (Medium Risk).

iii. Gadaikan emas yang sedia ada untuk mendapatkan tunai dan gunakan untuk buat belian baharu pada paras $1250 & $1180 (High Risk).

Sekian, moga bermanfaat.

Wednesday 6 November 2013

Gold Daily and Silver Weekly Charts - A Banquet of Consequences

06 NOVEMBER 2013

Gold Daily and Silver Weekly Charts - A Banquet of Consequences

"Everybody, sooner or later, sits down to a banquet of consequences."

Robert Louis Stevenson

Gold was held below the $1320 level and silver the $22 level once again.

I tend to think they are coiling for a move, but we will probably have to wait while Twitter comes out to play, and the Bureau of Labor Statistics squeezes out another Non-Farm Payroll Report on Friday.

We finally had a little action in the Comex warehouses. I will be posting on that separately later tonight.

You may have heard that a group of traders have come forward claiming that they have proof of price manipulation in the Brent Crude market.

Let's see, at last count that makes about EVERY major market that has been rocked by a profound scandal of price rigging and market manipulation, enabled or perpetrated by a major player in the Anglo American banking cartel. There is all kinds of weird shit going on, but nothing to see here in precious metals markets, so move along.

As the Lord asked Noah, at least according to Bill Cosby, 'how long can you tread water?'

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Bernanke in Twitterland

We start hitting the substance of the economic reports with GDP tomorrow and Non-Farm Payrolls on Friday.

The Twitter IPO looms over the market action as well as the real economy, and I have a sneaking hunch that the Street will support stocks until Twitter gets shoved out the door tomorrow, and perhaps for a few days after. As you have probably heard it is coming out on the higher side of $26 per share. Let's see how it does in the market.

I am not in stocks here, but am fighting an urge to get something going on the short side until we get a better idea if they can keep this pig in makeup for the year end ramp at least. Twitter may give us some insight.

This market is built on a foundation of meringue, supplied by those little elves at the Fed, who are pumping huge sums to Wall Street while Main Street languishes with little excess buying power and a floundering median wage.

While the Fed does not control fiscal policy, they have a huge amount of leverage as a primary bank regulator that they are not using well.

Have a pleasant evening.

Massive Drawdown of Gold From the West Continues, Falling into the Abyss Commodities / Gold and Silver 2013Nov 06, 2013 - 11:38 AM GMT

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

By: Jesse

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, September 1999

“In times of change, learners inherit the earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists.”

Eric Hoffer

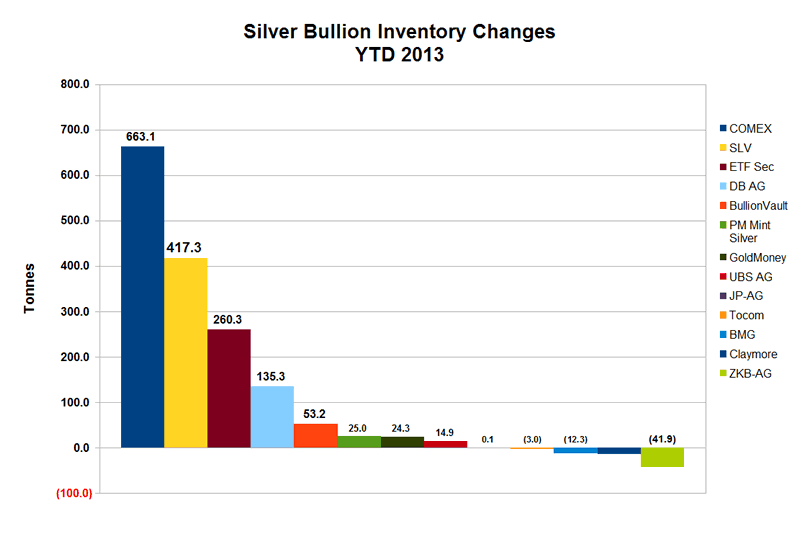

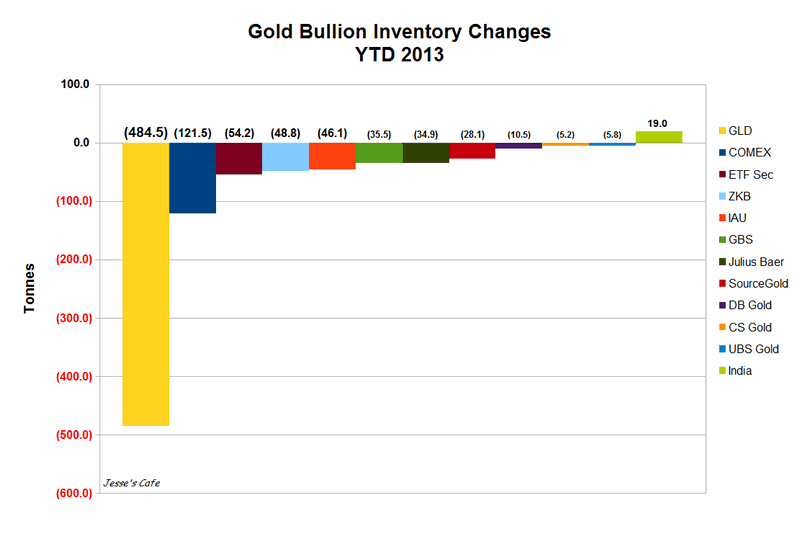

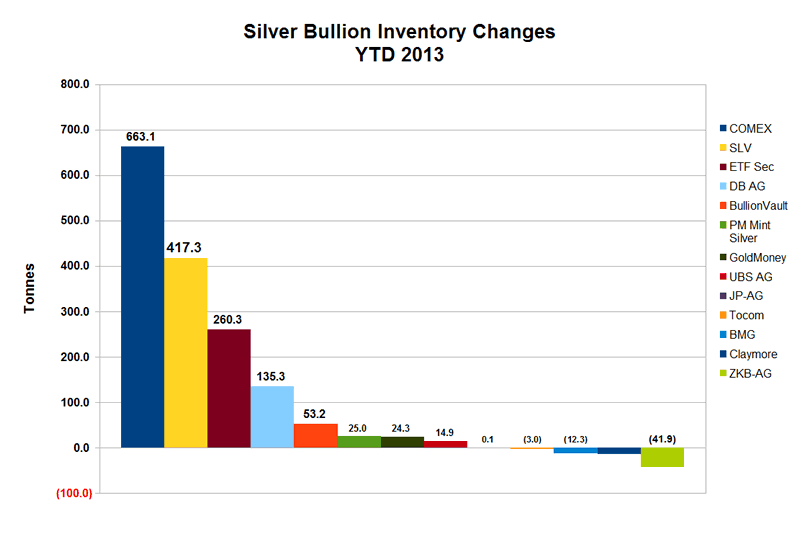

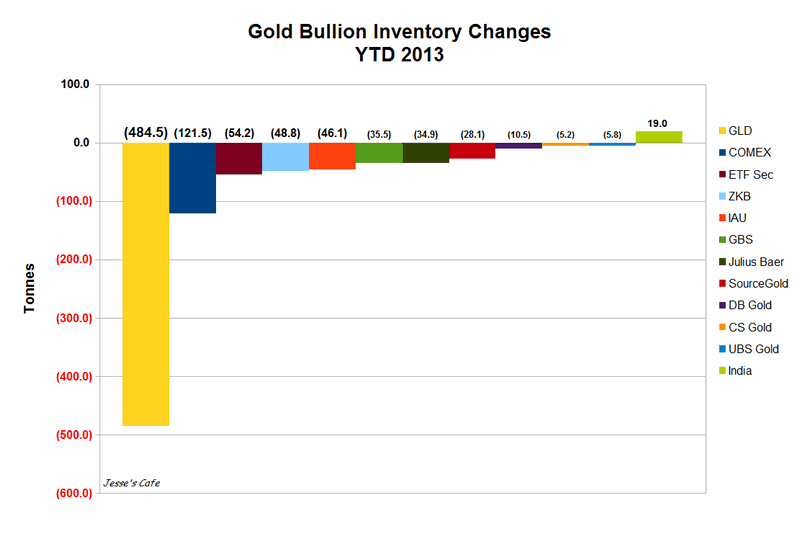

Here is the change, in tonnes, in the inventory of major exchanges and ETFs for gold and silver since the beginning of the year. Nick Laird of Sharelynx.com was kind enough to share the data which he has collected with me. He does a remarkable job in maintaining an enormous amount of data at his site.

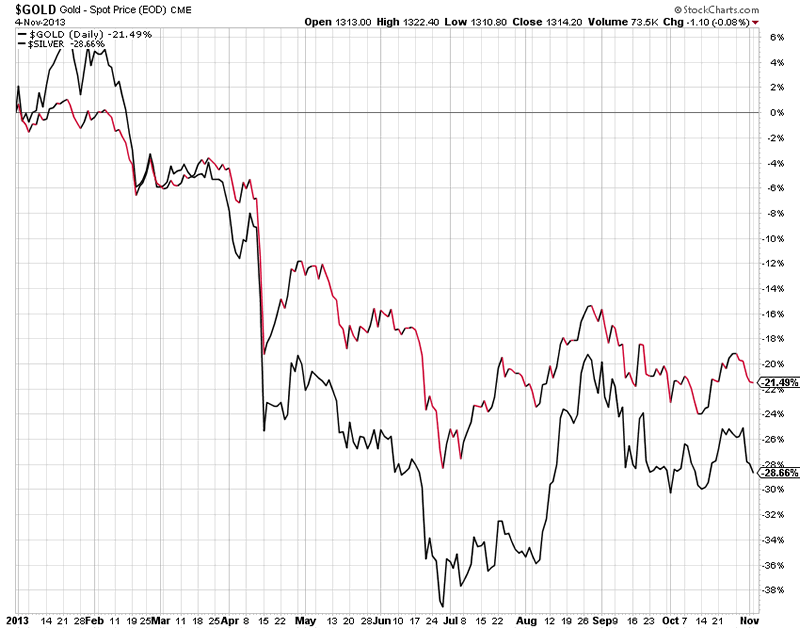

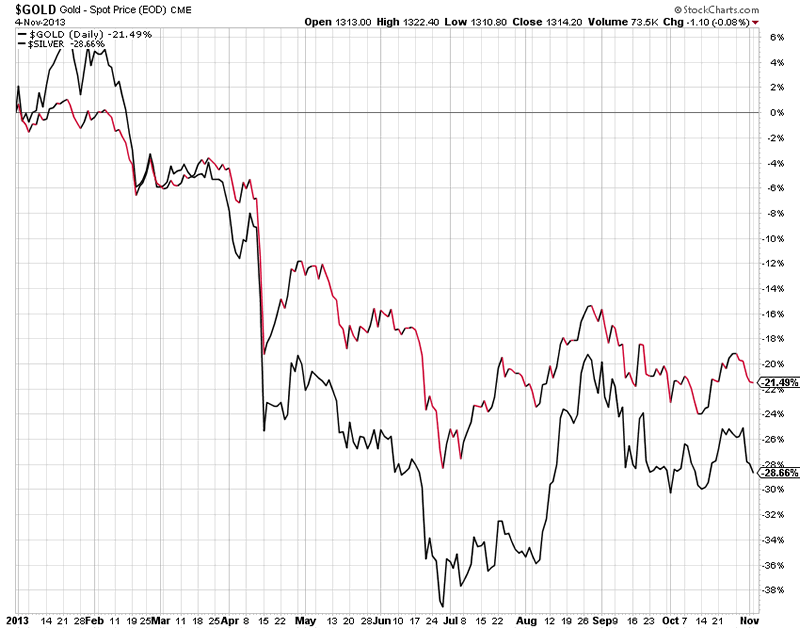

As you may recall, both silver and gold have seen price declines since the beginning of the year. As a reminder, silver is down 28.7% and gold is down 21.5%. I show this in the last chart. So they have both seen comparably stiff price declines this year.

Since the beginning of the year, the major exchanges and ETFs for silver have added about 1,494 tonnes of bullion.

Here is the change, in tonnes, in the inventory of major exchanges and ETFs for gold and silver since the beginning of the year. Nick Laird of Sharelynx.com was kind enough to share the data which he has collected with me. He does a remarkable job in maintaining an enormous amount of data at his site.

As you may recall, both silver and gold have seen price declines since the beginning of the year. As a reminder, silver is down 28.7% and gold is down 21.5%. I show this in the last chart. So they have both seen comparably stiff price declines this year.

Since the beginning of the year, the major exchanges and ETFs for silver have added about 1,494 tonnes of bullion.

But what is absolutely remarkable is that since the beginning of the year the Comex and some of the major ETFs have LOST about 856 tonnes of gold bullion. And I suspect much of that bullion has gone to the non-reporting vaults in Asia and the Mideast. And there is import/export data that corroborates that hypothesis.

Now, some might say that they don't see what this means, that they don't see the significance. Or that the significance is that people like silver but don't like gold, even though both have seen price declines, and even though demand for physical gold in Asia and the Mideast has been explosive this year according to trade records.

I will tell you what the significance is. The significance is that you are, figuratively speaking, watching water running uphill and out of sight. And some look at this and say, nothing to see here.

That gold which is disappearing from the reporting grid will not be coming back to these largely western vaults anytime soon. And it certainly will not be coming back at these prices. It is going into some fairly strong hands with an eye to the long term.

Silver is still acting like a precious metal, similar to platinum, which added 21 tonnes, and palladium which added about 1.5 tonnes.

Here is what is happening, as shown in the three charts below. Draw your own conclusions. But keep in the mind the negative gold forward rates and record leverage in potential paper claims for physical gold that we are seeing and hearing reported.

And this chart does not include the leased gold that is being occasionally disclosed by Western central banks, which seems to be going to satisfy the appetite of Asia.

It seems pretty darn obvious to me that there are some big buyers outside this reporting system that are taking down supply, and at a fairly aggressive rate, especially in the last twelve months.

I will tell you what the significance is. The significance is that you are, figuratively speaking, watching water running uphill and out of sight. And some look at this and say, nothing to see here.

That gold which is disappearing from the reporting grid will not be coming back to these largely western vaults anytime soon. And it certainly will not be coming back at these prices. It is going into some fairly strong hands with an eye to the long term.

Silver is still acting like a precious metal, similar to platinum, which added 21 tonnes, and palladium which added about 1.5 tonnes.

Here is what is happening, as shown in the three charts below. Draw your own conclusions. But keep in the mind the negative gold forward rates and record leverage in potential paper claims for physical gold that we are seeing and hearing reported.

And this chart does not include the leased gold that is being occasionally disclosed by Western central banks, which seems to be going to satisfy the appetite of Asia.

It seems pretty darn obvious to me that there are some big buyers outside this reporting system that are taking down supply, and at a fairly aggressive rate, especially in the last twelve months.

You know that I think this exercise was triggered by the revelation that Germany's gold was missing, and a reflexive price manipulation that was intended to dampen demand, but instead set off an avalanche of physical buying.

Given that genuinely new gold supply is only added slowly from mining, once the West realizes what is happening the turnaround could take on the character of a short squeeze, and perhaps even a panic and market dislocation to the upside.

And if you are one of those who are holding receipts for gold held in this system, you may find that you have been rehypothecated with extreme prejudice, and given a forced cash settlement at another's discretion. When the time comes your assets may be found to have been used as cannon fodder in the currency war. Thank you for your support.

The German people asked for their national gold back, and were told by the Fed to go sit down in the lobby for seven years and wait for it. Are you kidding me? What is it going to take to wake people up that something has gone seriously wrong in these markets?

The German people asked for their national gold back, and were told by the Fed to go sit down in the lobby for seven years and wait for it. Are you kidding me? What is it going to take to wake people up that something has gone seriously wrong in these markets?

What kind of new fraud or disclosure of fiduciary misbehavior will it take to bring the dawn? And what will happen when the dawn finally comes? Do you wish to be standing in a very long line holding a warehouse receipt or brokerage statement? Good luck with that.

You may be a financier, fearing the abyss and hanging on, obsessively doing what worked in the past. But here is some news. You don't have to fall into the abyss, the abyss is coming for you. And the longer this nonsense continues, the worse the drawdowns will become, and the more painful the final reckoning will be.

You may be a financier, fearing the abyss and hanging on, obsessively doing what worked in the past. But here is some news. You don't have to fall into the abyss, the abyss is coming for you. And the longer this nonsense continues, the worse the drawdowns will become, and the more painful the final reckoning will be.

Weighed, and found wanting.

Stand and deliver.

Stand and deliver.

By Jesse

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_4.gif)